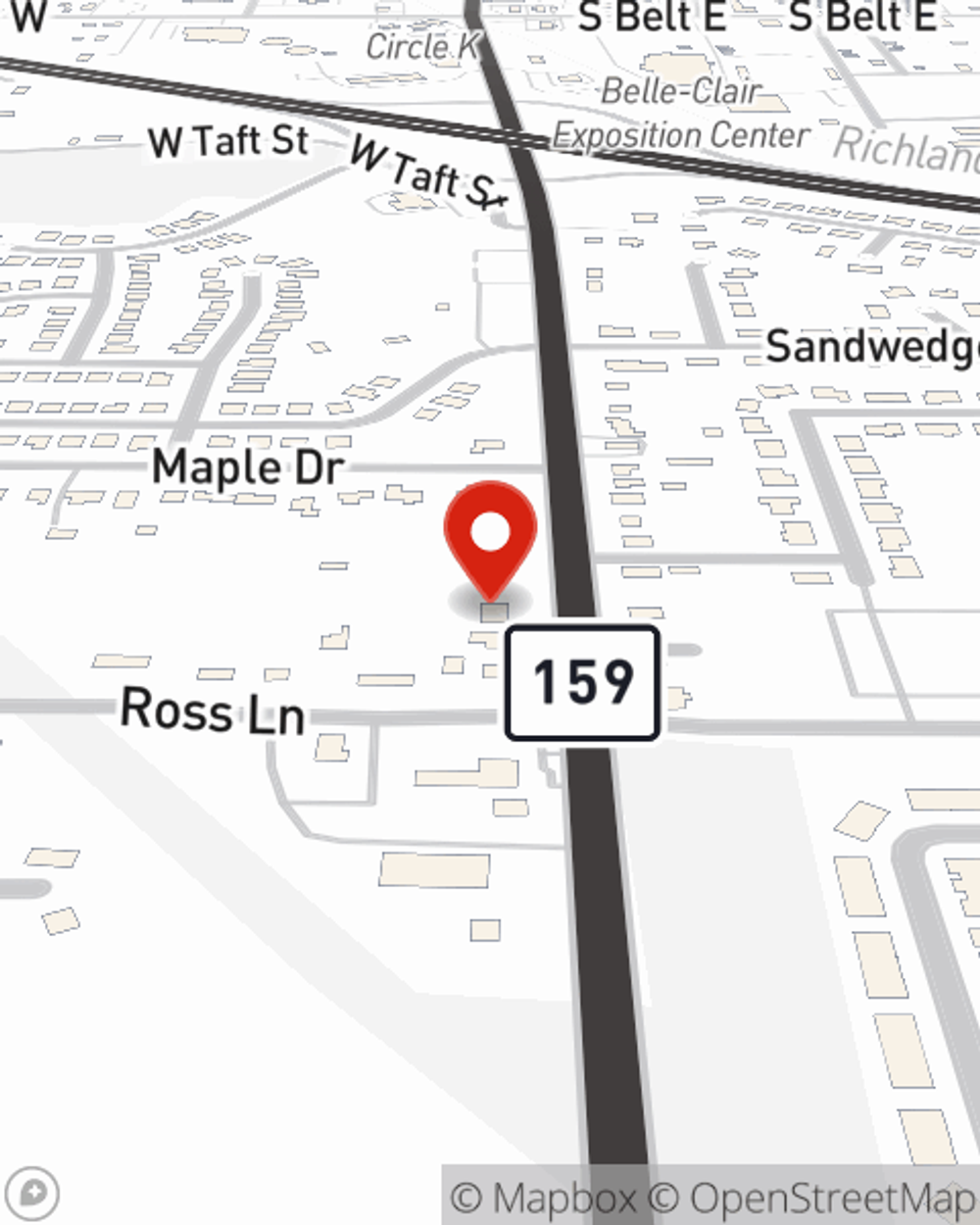

Business Insurance in and around Belleville

Looking for small business insurance coverage?

Insure your business, intentionally

- Smithton

- Swansea

- Millstadt

- Saint Clair County

- Scott Air Force Base

- Freeburg

- Hecker

- Fairview Heights

- O'Fallon

- Mascoutah

- Lebanon

- Red Bud

- Columbia

- New Athens

- Waterloo

- Cahokia

- Caseyville

- Dupo

- Collinsville

- Monroe County

- Ruma

- Randolph County

- Shiloh

- Saint Louis

Cost Effective Insurance For Your Business.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Mishaps happen, like a customer hurts themselves on your property.

Looking for small business insurance coverage?

Insure your business, intentionally

Insurance Designed For Small Business

Protecting your business from these possible problems is as easy as choosing State Farm. With this small business insurance, agent Krys Jacobs can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

Eager to explore the specific options that may be right for you and your small business? Simply visit State Farm agent Krys Jacobs today!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Krys Jacobs

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.